13 July 2008

Welcome to the Weekly Report. Normally at An Occasional Letter From The Collection Agency we try to focus attention on the macro-economic near term effects using the Weekly Report, allowing the Occasional Letter to look further into the future by about 18-24 months. We have reached a stage now where it is becoming difficult to keep the various strands of my convoluted thoughts distinct and clear for the readers so, in keeping with one or two other writers it is time for a re-cap.

My first public post on a financial site was 21 months ago so the timing is right. Unfortunately for the readers of my eco-babble I cannot do a 6 month resume, so here it is, a 21 month review of my work. We start off with a quick update to last week and a quirky question and then into the meat of the review.

Last week I opened by saying even I was worried about my own bearishness, using my own thoughts to make me think about possible supports (highlighting LTCM levels as possibly the area to watch for banks and financials). I am still watching this level. If support doesn't hold we are on our way down to the 9300 area on the Dow, eventually.

I have very little to sell, my little website was set up using the Austrian School of Economics as a guideline, it ticks along at a minimal cost to members because I didn't incur any debt or debt servicing costs to set it up. The capital I use is from savings and is repaid by the small subscription I charge, it even makes a small profit which when saved over a period of time may allow me expand the facility. If all my subscribers left tomorrow I could close the site down and walk away without having incurred any loss and move on to something new.

Now apply that line of thought to every single company in the S&P500. Can you find a single company that would be able to follow the same path? If you can, let me know because it would be nice to find a well run, properly capitalised Large Cap to put on the "long" watch-list. Remember, no debt. That includes bond issuance. If you wanted to be really at the cutting edge of investment in the new era of capitalism that will rise from the ashes of this Monetarist / Keynesian credi t/ debt orientated fiasco, check out the Funds in your portfolio, any leverage being used? The expression that "cash is king" is going to become the"new" catchphrase in the near future.

It is here that I have to do a recap of my previous remarks and comments about the economy. Unlike many bloggers and writers who are looking at the next Quarter or the second half of '08 and recounting what they said in March, my view has to go back much further than that to see if what I wrote about last year or earlier is coming to fruition. It is the only way I can help readers understand how my poor befuddled brain works. Now I cannot re-create each article here but what I can do is give you a link and a couple of key words or a phrase with the date of the article.

Is this an ego trip, a boost to my already self enhanced view of my abilities? Not really, it's just a way of showing you my timespan, how my thought processes work, you will find the odd wrong call too. So here we go:

A First Sighting originally written in November 2006:

- "A lack of cash, driven down by tighter, more expensive credit, a lack of liquidity that starts at the bottom and works its way higher up the food chain, until even those, referred to in whispered tones as daz boyz, see that the health of the US economy is going to require a donation of wealth from everyone. Even them.

Can you see what I have caught a first sighting of?

And out there, somewhere in Hedgeland, someone is finding it more and more difficult to sleep at night, thinking about all those CDO's sitting on the books. No one to lay it off to, a one way bet on liquidity."

Gone in Sixty Seconds originally written in June 2007:

- "If you have debt you are bending over and picking up the soap.

Straightforward, no nonsense, in the prison block showers, soap collecting. Hopefully coffee has been spat at screens, wives/delicate husbands have been offended and stopped reading within 60 seconds. Because what I'm about to impart to you should make you feel this way. You, Joe Public, are about to be ridden into the oblivion. No one can save you, no one really cares. Big boyz, from companies like mine are going to take your possessions away. Faceless corporations are going to take your home away. All because you have debt."

The Second Sighting originally written in September 2007:

- "This leads us back to a rather large problem. In fact its huge problem and its not being talked about out there in Media land. What happens to a tapped out consumer, loaded with debt, trying to roll a teaser/innovative (thanks AliG) mortgage if rates are going up? It's not going to happen, it's a train crash. Borrowers are already operating under tighter credit controls so the ability to re-fi is curtailed for many. Add in much higher rates and the situation becomes impossible. Banks are going to suffer from a curtailed income stream, as debt default rises, just as the teaser rates for the Banks' borrowings come to an end and reset much higher. Can you see the irony?

Banks are no better off than over stretched sub-prime mortgage borrowers. They need an income stream from lending to ensure they can pay the liabilities they owe to savers, savers that will demand higher yields. It's unsustainable and it's going to stop, soon.

Banks are hit with a double blow, as a lack of income leaves them either unable to service their own debt and default or forces them into repaying the debt using capital holdings or returns from assets sold in the markets. Either way, credit for business and consumers becomes impossible to provide. A massive contraction of activity is a given.

It's been noticeable of late to see the recession word crop up, even in the mainstream media. I think they are wrong. I think the future contains a scenario much worse than a recession.

So, my forewarned reader, will you be leaving your money in a "sub-prime" bank?"

I want to walk you through why I see deflation in the future.At this point I have to make something clear, whilst the traditional view of deflation is less money in the economy, I do not see cash as the current driver of inflation/deflation. The mover is credit. Allowing an unfettered increase of credit to replace the traditional over printing of notes to sustain a bubble(s) or ponzi scheme (if banks have, as a % of loans, effectively no reserves, what else can the system be based on?) then a reduction in credit must be deflationary.

The importance of this cannot be under-estimated. Credit itself has/is being used as an asset to beget more credit. This explains the exponential rise in credit; it feeds on itself as credit notes become the asset to allow further credit to be lent out. By allowing credit to underwrite itself to form other types of credit the whole system becomes reliant on the confidence of lenders and borrowers having the means to eventually repay. If that confidence is put under pressure, the system stops. If confidence cannot be restored in a very short timescale (Central Bank / Tsy intervention) then the system begins to reverse, as credit is redeemed. The reversal will be at the same pace as the initial rise in credit growth. Although painful, the reversal would be orderly, as long as all the borrowers have the ability to repay. If that ability to repay is impaired then the redemption becomes disorderly.

- "So is Mr Bernanke getting undeserved criticism? I think he is and I think I know why. There is a war on Wall St right now and it's viscous. There are interests that need protecting, accounts that need to be kept hidden and rescues that have to be carried out. All of this has to happen in conjunction with falling rates. If it doesn't happen quickly, with the full cooperation of the Regulators, Fed and USTsy, then whole ponzi scheme comes crashing down. Someone though isn't giving out enough covering fire. Mr Bernanke is keeping some of his powder dry by not telegraphing further rate cuts, in fact you could easily see a case for rate rises if some of the downside risks become too big to ignore.

Wall St doesn't like it. The last thing the Cabal expected was that they would have to use their own money to sort out their own mess.

Is Mr Bernanke getting bad press at the behest of Wall St?"

The Event Horizon For Credit originally written in November 2007:

- "You can now see why, as a result of a flat to falling monetary base coupled with a contraction of credit, I see the risks of a deflationary recession as a very high probability. A depression is not as remote as many think.

Is this just a US-centric problem? Not according to Esteban Duarte and Steve Rothwell at Bloomberg, who unearthed this:"

- Europe Suspends Mortgage Bond Trading Between Banks

Nov. 21 (Bloomberg) -- European banks agreed to suspend trading in the $2.8 trillion market for mortgage debt known as covered bonds to halt a slump that has closed the region's main source of financing for home lenders.

The European Covered Bond Council, an industry group that represents securities firms and borrowers, recommended banks withdraw from trades for the first time in its three-year history until Nov. 26. Banks are still obliged to provide prices to investors, according to the statement today.

Banks including Barclays Capital, HSBC Holdings Plc and UniCredit SpA took the step as investors shun bank debt on concern lenders face more mortgage-related losses than the $50 billion disclosed. Abbey National Plc, the U.K. lender owned by Banco Santander SA, became the third financial company to cancel a sale of covered bonds in a week as investors demanded banks pay the highest interest premiums on covered bonds in five years.

``We are in a deteriorating situation,'' Patrick Amat, chairman of the Brussels-based ECBC and chief financial officer of mortgage lender Credit Immobilier de France, said in a telephone interview. ``A single sale can be like a hot potato. If repeated, this can lead to an unacceptable spread widening and you end up with an absurd situation.''

"You can find more about Covered Bonds at: http://ecbc.hypo.org/Content/Default.asp - if you can spot the difference between a CB and the MBS, ABCP or ABX derivatives then you have a keen eye.Oh, and yes, you read that correctly - that is a $2.8 Trillion lending market that has been closed. No wonder LIBOR has been climbing to new 2 month highs and above and reaching new all time high in spreads from the Fed Funds Rate.

You are probably realising that this weekends events are not a surprise to me. As you can see my eco-babble ratcheted up as my first blog came into existence, prior to the blog I published my thoughts on financial bulletin boards, I moved on as the spammers began to disrupt any possible conversation and a core demand grew for my thoughts. Now I know you want more, especially as it is free, so refresh that beverage and we will move forward into 2008. First though was my long term warning about the state of the Stock market, given to readers as a Christmas present in December 2007:

Edwin Coppock, Fed Fund Rates and The Dow

- The next chart shows 2 things. The first is my dire attempt to display what I consider to be the best chart of the year. If only I was better at this graphics stuff eh? Ah well readers, you can't have everything..... The second is the chart itself. I have overlaid a chart of the Fed Fund Rates from 1986 to present with a monthly chart of the Dow from 1986 with its Coppock Indicator. It's clear to see the CI before 1996 did indeed lag and post '96 it's a much better tool. Although the CI is used to indicate a bull market on a rise through zero it can be seen that in either half of the chart CI did give a lower high before stocks broke lower (marked by faint red lines). What's more those lower highs were divergent when compared to the Dow which made higher highs:

- So, what are the Coppock, Fed Fund Rates and the Dow trying to tell us now? Firstly a rider. Although Fed Fund Rates are falling, other rates, especially LIBOR are not. We should keep this in mind. Firstly, we have a falling CI, with a divergent lower high when compared to the Dow. The Dow itself is beginning to resemble the 1999/2000 top, without a lower low as yet. Fed Funds are dropping and if consensus (a warning in itself) is correct, FFR will be much lower next year.

With the CI acting in a much more timely fashion, the minimum we can expect is for a flat return on stocks whilst FFR has ongoing cuts and the downward direction of the CI is maintained. A lower low on the Dow would make the flat return scenario seem less likely and open up expectations of a larger fall in 2008.

Are you thinking I may not be specific enough? Well I don't like to mention specific calls on individual shares, that's not really what I am about but this one had reached an important level:

Citigroup - Opportunity or Death Rattle? Originally published in January 2008:

- "The current low is different, a sustained period of selling continues whilst the oversold condition persists. It is the opposite condition of continued buying whilst in an overbought condition as seen in 1999/2000. Unless a financial miracle occurs Citigroup is going lower, 1998 anyone? If my suspicions come to fruition then the price may well end up quoted in cents."

Automobile Wreckage. It Isn't just Ford and GM

"We see the same deterioration in price and the widening of spread that has become so familiar in the CDO/MBS indexes. As with housing, the inability to create further derivative structures due to rising spreads (risk premium) will curtail the lenders ability to clear the balance sheets and facilitate further lending.It isn't just the Markit.com index which is dropping. TRR (Total Rate of Return) CLOs are struggling too as Fitch Rating Agency has noted, downgrading 28 tranches and also placed an additional 37 tranches on Rating Watch Negative. Unsurprisingly TRR CLOs are a mixture of derivatives of loan portfolios that according to Fitch are now at risk for intensified spread/credit risks. Market values on the SMi U.S. 100 have fallen 6% since mid '07. Considering the type of asset and its potential lack of worth in a flooded market (unlike housing) I expect spreads to widen considerably.

It seems to me that a combination of tightening credit for the consumer, caused by the inability of lenders to clear balance sheets due to derivative markets pricing in higher risks which is stifling new issuance, will cause a real fall in spending on Autos. It should not be forgotten that other unsecured debt will have the same problems.

The possibility of widespread damage in the US domestic Auto industry beyond GM and Ford seems much greater today than at any other time."

AIG Get Caught By The Auditors originally written in February 2008:

"Support at the $50 seems bust and the threat is a monthly close below the '03 low. It's yet another chart that flags up the lows from 1998. I'm not saying it's a short (or a long) that's not my job. I just want you too see something that looks worse than me in the mornings.By the way, be careful of who you listen to. This was one of the comments I saw on Bloomberg about the AIG drop:

"Investors eventually will look back at yesterday's announcement and conclude they overreacted, said David Katz, chief investment officer for New York-based Matrix Asset Advisors, who supports Sullivan (the CEO)." Must be a coincidence......

Then again we are at point in the markets were hope is being ladled out to the hungry and despondent. As I write this little snippet appears:

"U.S. Industry: Uber-investor Warren Buffett on tv making remarks about the monoline insurance industry, apparently has offered a reinsurance plan to those firms. Talk has boosted the recently ailing monolines and is said to be behind the solid bounce in US stock futures in recent trading. Provided by: Market News International"I have some bad news for Mr. Buffett. This isn't the bottom even for the better quality debt. As I have maintained for some time contagion in the derivative bond market is deeper than anyone realises and it has spread beyond investment and traditional banks. AIG know that only too well.

By now I was producing the Weekly Report and this particular issue got a huge number of hits:

The Weekly Report 25 February 2008:

- "Now, I am not going to give you advice on what to do about your cash on deposit and I don't want you to think I am being overly bearish but…….I have called this whole fiat credit collapse correctly from the beginning. No, I don't want a pat on the back. I just want to read the next line carefully.

If I had money in a US bank today, I would be worried. So worried I would withdraw the cash before new regulations are passed restricting account activity. I know it sounds alarmist but then the first warnings always do."

This from CNN Money:

"Customers with uninsured deposits will get at least half that money back, and they could get more back, depending on what the FDIC gets when it sells the bank, said FDIC Chairman Sheila Bair. IndyMac customers will have their funds transferred to a new entity - IndyMac Federal FSB - controlled by the FDIC. They will have uninterrupted customer service and access to their funds by ATM, debit cards and checks.However, customers will have no access to online and phone banking services this weekend, according to the FDIC. Service will resume on Monday. Loan customers were advised to continue making loan payments as usual."

On the 3rd March in the Weekly Report I wrote this:

- For those who think a run on the $ would be inflationary, think again. The pressures placed upon the financial system would be overpowering. It would collapse, within hours. A fiat system without access to credit would result in instant depression. It doesn't matter how "expensive" assets are if you cannot buy them. For instance, taking account of Fed Pres Poole remarks, the opportunity has arisen were speculators can start to look at shorting GSE's and the $.

The Fed is playing an incredibly dangerous game and I suspect it is about to be called after going "all in".

But what of the future you say? Get another coffee and we will look forward to what I think maybe in store for us all.

How close is the Federal Reserve to a margin call? Well, anecdotal evidence is pointing to a need for the Fed to open the discount window to bailout Fannie and Freddie. In an article published on the 12th March, Pre-emptive Warning of a Major Banking Crisis I highlighted this snippet:

- "Right now the Primary Dealers are purely a front, emperors without clothes. Ben Bernanke is literally behind the curtain, pulling the levers. The problem for the Bernanke is the lack of levers, the SOMA is a finite resource, which I estimate to have $600Bn (ish) of usable collateral available."

- "Collateral for U.S. currency in circulation and other reserve factors that show up as liabilities on the Federal Reserve System's balance sheet "

Of course the real risk is to the Banks, Brokers and Insurers. All that GSE debt is AAA rated, as good as cash, and is classed as Tier 1 type assets - or it was until this week.

The problem? This:

- "GSE securities are booked as risk-free investments by banks owing to an "implicit guarantee" assumption attributed to the GSE's. This relief is theoretical and changes in regulation may affect this assumption."

If you think this is far-fetched then have a chat with Merv King over at the Bank of England who made sure the restrictions below were included in the terms and conditions of the Special Liquidity Scheme, as quoted in the Weekly Report for the 27th April 2008:

- "The main category of assets will be securities backed by residential mortgages. Securities backed by credit card debt will also be eligible. These assets will be high quality - rated as AAA. If the assets were to be down-rated, banks would need to replace them with AAA assets. The facility will not accept raw mortgages and none of the underlying assets can be derivative products. The Bank of England routinely accepts assets denominated in currencies other than sterling. It will not accept securities backed by US mortgages."

Either more reserves will have to raised to cover the loss of value to these Tier 1 assets or the banks may decide that marking to market is "difficult" and enact the recently passed legislation, moving the assets down to tier 2, or 3. Either way, the liability for banks will go up. Basel 2 once more comes to the fore.

Some are relying on the possibility that this:

- " The Senate measure would create a new $300 billion government-backed foreclosure prevention program and strengthen oversight of Fannie Mae and Freddie Mac."CNN Money.

- "Trone in a research note estimates that JPMorgan Chase's total exposure -- holdings of GSE debt, mortgage-backed securities and counterparty risk -- is $87 billion, or 69 percent of its equity.

Citigroup has exposure of $51 billion, or 40 percent, while Goldman Sachs has the largest total exposure among investment banks at $14.2 billion, or 32 percent of equity.

In addition, GSE bonds and mortgage securities generate underwriting and trading business that have fueled Wall Street profits for years."

- "As we work through this tough housing market, we are maintaining a strong capital base, building reserves for our credit losses,"

Freddie Mac on the other hand took a slightly different approach, after the usual bluster, easily summed up as everything is okay, Freddie then went on to say this:

"Beyond that, there are a number of options to manage our capital position. The average rate of run-off on our retained portfolio is currently about $10 billion per month, and not replacing that run-off would free up approximately $250 million of capital per month. Over the course of a year, this would free up approximately $2.5 to $3 billion of additional capital if this run-off rate remains constant. We also could consider reducing our common stock dividend. Our current annual common stock dividend is approximately $650 million.Currently, Freddie Mac's liquidity position remains strong. This is a result of the combination of two factors: access to the debt markets at attractive spreads and an unencumbered agency MBS portfolio of approximately $550 billion which could serve as collateral for short-term borrowings. "

Who is left to lend to the GSE's? I don't see the Banks rushing in - do you? The answer is the Lender of Last Resort, the tax payer. What of the moral hazard that grows daily as the US Fed and Gov't commit more and more dollars to this expanding mess? I wrote a warning in the 25th May 2008 Weekly Report of the need to keep tight control:

"To avoid moral hazard arising, strict controls have to be placed upon the facilities that are created and the use of the assets supplied from those facilities. A failure to control the results of centralist intervention will encourage the very behaviour that caused the original problem.Let me be blunt. There is no risk to the financial sector that is so great that could justify invoking a moral hazard. If a bunch of banks and investment houses collapsed under the strain of unserviceable debt or losses so great that creditors required compensation, so be it. The pain would be enormous and the recession deep but the US economy and importantly the US financial sector would re-emerge stronger, leaner and fitter than at any time since WW2.

As we know such an event will not be allowed to happen, the Fed and the US Gov't are working together to ensure that credit markets at least allow maturing debt to be rolled over, giving time to the banks and investment houses to rebuild their capital reserves. It is a 2 pronged attack, the Fed keeps the banks functioning and the US Gov't drops money directly onto consumers in an effort to encourage spending or re-finance mortgages that have become too burdensome. These measures have no time limit, they can be repeated and increased until the day occurs when banks tell the regulators "all is well".

The groundwork for an episode of moral hazard is laid out but not yet constructed as long as the facilities are controlled and the assets applied to the task at hand."

To give you some idea of the attempt to increase inflationary expectations, read this excerpt from someone we have already quoted today:

- "US HOUSING: Federal Deposit Insurance Corporation Chairman Sheila Bair outlined in an Op-Ed piece in today's Financial Times a proposal that would assist one million homeowners who are facing foreclosure. The plan proposes that Congress authorize the U.S. Treasury to use $50 billion to make loans to borrowers with unaffordable mortgages to pay down up to 20 percent of their principal. The repayment and financing costs for these Home Ownership Preservation (HOP) loans would be borne by mortgage investors and borrowers. This approach is scaleable, administratively simple, and will avoid unnecessary foreclosures to help stabilize mortgage and housing prices."

And what of the future, are we going to continue to stagger from one financial implosion to another, constantly increasing liabilities in an effort to keep the system going? Without a doubt the Governments and Central Banks will attempt to follow this path, sacrificing your future to preserve the present for a corrupt, failed and illegitimate financial system based on a branch of economics discredited not once, or twice ('30s and '70s) but now for a third time.

Yet I see a different outcome, one that is reaching towards its final conclusion:

- " A recap of the scenario: bubble, easy money, inflation in fiat money supply, inflation in commodities and hard assets, inflation, fear of inflation, rising rates, YC inverting, flattening, rising and inverting again, tightening, withdrawal of liquidity, corrections, crashes, talk of stagflation, FEAR, withdrawal of speculative funds, further corrections and crashes, demand collapse.......Deflation."

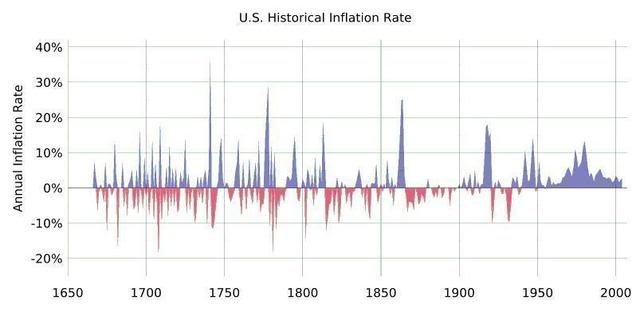

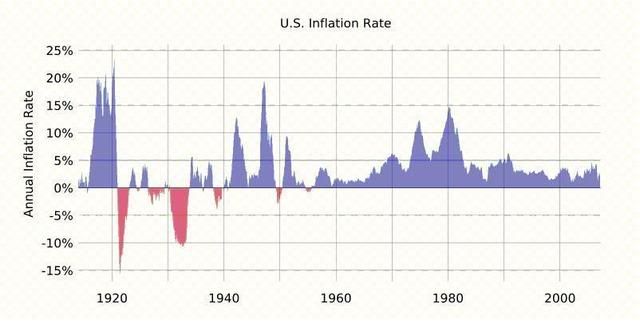

After the deflationary experiences of the '20s and '30s the Fed embarked on a strategy to eradicate deflation and to control inflation using interest rates.

Yet today we see Fed Fund Rates at 2% whilst price inflation, caused by the pass though effect of the rising costs in the production of goods, remain stubbornly high. The Fed isn't fighting inflation, it is fighting deflation as it attempts to divert the effects of the great credit crash and de-leveraging of the financial system. The Fed understands that current price inflation is the legacy of loose credit availability, the feed though effects of the massive expansion of credit used to escape the deflation scare in 2002.

Yet despite the Feds every move, credit is being wiped out as losses and de-leveraging reduce cash reserves and banks tighten their lending standards to the extent that many are avoiding the market.

The situation is a copy of that in '29-'32 and similar to '37. Banks are unwilling to lend and are doing all they can to raise capital, cash is king. Prices of goods and commodities are reaching levels that are causing buyers to stop and think, not just consumers but Governments too:

- "BANGKOK (Thomson Financial) - Japan has turned down 60,000 tons of rice from Thailand after the asking price nearly doubled in the space of a month, the Thai Rice Exporters Association said Wednesday.

Chookiat Ophaswongse, president of the association, said Thailand on Tuesday offered the Japanese government 100 percent white rice at $1,300 per ton -- up from the $720 it paid in March.

"This time, Japan turned it down, saying that the price was too high for their budget," Chookiat said, adding that Japan did not want to be seen as a country pushing up global rice prices."

A consumer retrenchment of proportions never before seen approaches. The temporary relief of tax rebates for US consumers has passed; it was noticeable that the main beneficiary was Wal-Mart, not the specialist or high end part the retail sector. The rebate was spent on essential or near essential goods.

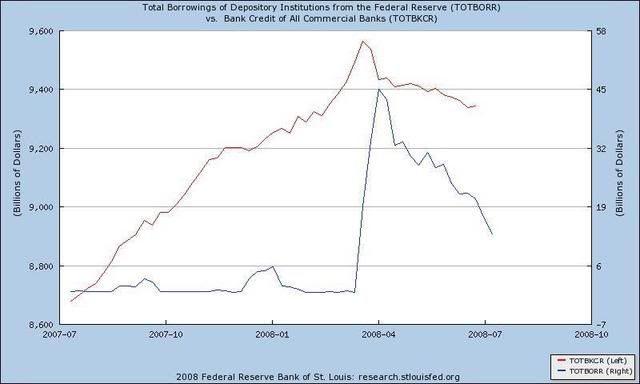

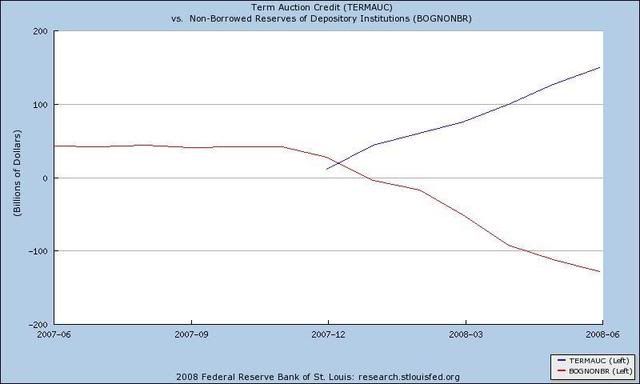

It will be the inability of consumers and business to buy assets or services that will force prices down as the suppliers seek to keep market share. Are there signs that the availability of credit is going negative coupled with a reluctance of banks to do business?

Credit is contracting along with borrowing. The banks are deleveraging and unwinding positions at an accelerating pace. Banks continue to keep credit standards high and discourage borrowing by charging higher rates, or in the UK by not passing on Central Bank base rate cuts.

When will we know the process is finished?

We have a way to go. At a rough guess, US Banks and Institutions need to unwind $200Bn of capital. At a leverage of say 10, that's $2Trillion of positions, minimum.

Is there any sign of relief for the stock markets in the near future? The following chart (Dow weekly) shows the Dow since 2004 along with an important moving average, traditional support and resistance and a proprietary indicator. The vertical red lines identify turn points as flagged by the indicator.

I have had to compress the chart but it does show the change from low to high volatility. The head and shoulders, with a downward sloping neckline is textbook. The yellow highlight shows the retest of the neckline that took place over the past 2 weeks. If that neckline holds then the target for the Dow is 9305 (the lower thick purple line) minimum. The neckline is my line in the sand, circa 11430.

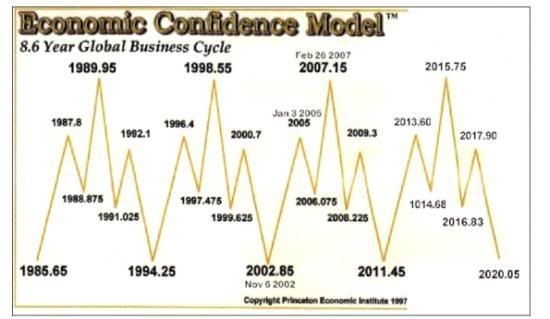

The diagram below is the Armstrong Economic Confidence Model:

Is the attempt by Governments and Central Banks to avoid the fallout from the credit crash and the horrendous damage being caused to the global economy doomed to failure?

My thanks to you all if you managed to stay with me to the end of this article. I firmly believe that this is how eco-bloggers, writers, analysts and fund shills should recap their calls on the markets. I do not believe a 6 month timespan is an effective window for investors to base their investment decisions on. What happened in the past does influence the future, the present is just those events unfolding.

Choices made over 10 years ago have influenced current events, those that dismissed the writers back then who warned of the possible outcomes will never be called to account, the memory of the market participants is too short. Those who did warn of the eventual outcome will get no recognition, unless they are one of the handful who managed to survive the snide comments and muffled laughter sent their way over the past decade.

I have no doubt we are in a bear market, a bear that will devour ALL asset types and not be restricted to stocks. A 20% fall in stock markets does not signal the onset of a bear, that was just a figure used by fund managers et al to keep you long in the market so you could absorb 20% losses. If that Head and Shoulders plays out a 20% loss will seem like a lucky escape.

During the last bear in stocks the advice from the vast majority of "advisors" was to stay in the markets, for many that meant unrecoverable losses. The advice back in 1929-30 was the same, most people only sold after they had taken enormous losses on their portfolios. Has it changed with the advent of the internet, satellite TV and mobile phones? No, it hasn't. All that happens now is the bad advice is delivered quicker that previously.

Bear markets are viscous, dangerous periods designed to make everyone hurt, including bears. Some of the biggest rallies in stock markets happen in bear markets. I do not expect markets to go straight down, you only need to look at 1998-2003 to see why.

Protect yourself, use stops, use only spare capital, be able to carry on with life if you lose your pot and stand back from the market, take a wider, longer term view. Finally be very careful who you listen to and what you read. When the overall pot shrinks those who need your funds to survive will do and say almost anything to try and make your wallet lighter.

This will be the last full article to be freely available for some months. If you like the analysis then consider visiting www.caletters.com and sign up to the 14 day free trial.