This week I want to aim the article at those who normally do not frequent financial bulletin boards or sites. You, the reader, need to help me in this cause.

People who read financial BB's are already interested and to some extent (though not always) informed about how certain economic conditions occur and can hold a healthy debate about the cures for such ills.

However we are a small group of independent thinkers, we exist at the margins where we try and do our best to inform the public about the dangers and benefits of our financial system. How many of us have watched our family and friends adopt a fixed grin and a glazed expression as we try and explain the complicated world of money flows, interest rates, inflation, deflation etc? We all know the moment when they stopped listening; it was when they started looking over our shoulder to see if there is someone more interesting standing behind us to talk to.

This Weekly Report is for those who glaze over. The trouble is the target audience doesn't read my website or these financial boards. So this week I want you to do a little something for me, send this article to your friends, the ones that now know something is wrong but don't realise what the problem is. It will be available, in full, on my old blog here.

However, before I start the article proper I want to share a little something with you. In April I wrote a series of articles about G B Eggertsson and how his paper "An interpretation of The Deflation Bias and Committing to Being Irresponsible" was being used by the Federal Reserve as the plan to escape from the deflationary effects of the credit crash. Three of the articles were subscriber only but I have now enabled those articles to be read in full without subscription of any sort at An Occasional Letter From The Collection Agency.

That's it, the second to last mention of my site in this article, you have permission to cut and paste this article from here (see the acknowledgement at the end) if you wish to send on to your friends and relatives who you think need to know what is coming. Reproduction on other sites is allowed too. This article uses the US and to a greater extent the UK to describe the background. It is applicable to all countries that allow a fiat currency.

How did this happen?

You will have heard of the sub-prime defaults, that credit conditions have changed, that banks are struggling. All these things are the not the cause of the current problems but are the symptoms of a system that allowed itself to become a one way bet, a self reinforcing merry-go-round of increasing debt. Let me show you how it works and how it breaks.

Mankind has only ever truly created one thing, fiat currency. Fiat currency is cash, paper and coins that are only backed by confidence, for paper they are promises to pay the bearer, coins have an intrinsic worth depending on the metals used to make them.(Hence why coins have become smaller and lighter over the years, production costs need to be below the notional worth of the coin). Paper has practically no intrinsic worth, except to paper recyclers.

Mankind can produce as much paper and coins as it wishes and since it is all based on promises, these days you don't even need a note, you can electronically promise "cash" too. Think about a mortgage payment. It is paid by an electronic transfer of an amount out of your bank account to the mortgage lender. The "cash" was originally placed in your account to be able to make the mortgage payment by electronic transfer from the account of your employer or your interest bearing savings / investment account. No real paper was used, no bags of coin delivered. It all happened electronically.

You can see the temptation such a system offers. You can invent money, lend it to others who pay you interest and at the end of the term you get the principal back too. You do not need to have any collateral to make this happen, though we do have regulations for banks that say they must have a reserve amount that is a percentage of the amount of money they invent. As all money in a fiat system is invented and relies on confidence, it doesn't really matter if reserves really exist or not, except to fulfil regulatory requirements.

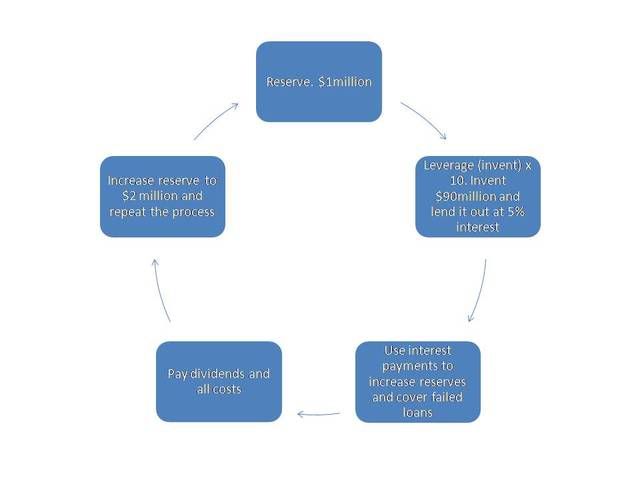

Let me show you the system in this simplified diagram:

At the basic level the system is that simple. As long as the costs and defaults are exceeded by the profit made from the interest received your reserves grow and enable higher levels of leverage. You can get very rich doing this.

However every so often in human history events make this simple idea break down. It doesn't matter what the event is but if it makes the costs higher that the interest received then the reserve shrinks. This stops the increasing levels of lending and in severe cases can cause lending levels to fall or even stop altogether.

This is what we call a credit crisis. They have happened before and caused the bankruptcy of many lenders. Those that survived such events usually did so because they refused to allow indiscriminate lending, they applied standards to borrowers, checking to see if they could repay loans and refused to leverage to the maximum potential.

If an economy is reliant on the ability to borrow to achieve purchasing power or increase productivity then a credit crisis has an enormous impact, stopping growth and commercial activity. This worries bankers who have no wish to join the list of "also ran" names of yesteryear. So they decided to try and protect their business model and move some, or all, of the risk to another sphere of the financial system. To do this they had to make such risk taking attractive to others by offering compensation.

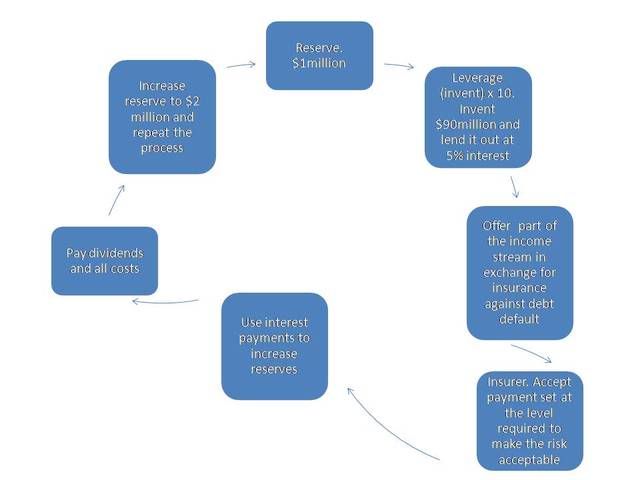

Again, here is our simple model but with a basic level of protection added:

You can see what has happened; the original bank lending system now looks stronger as the risk is lowered at the expense of some of the interest income. But notice how the model now becomes acceptable to the Insurer who can use the new income to raise their own reserves. What was a very simple model has now, with one change, morphed into a multi-party system that can be continuously expanded as risk is offloaded to other parties.

So what can go wrong?

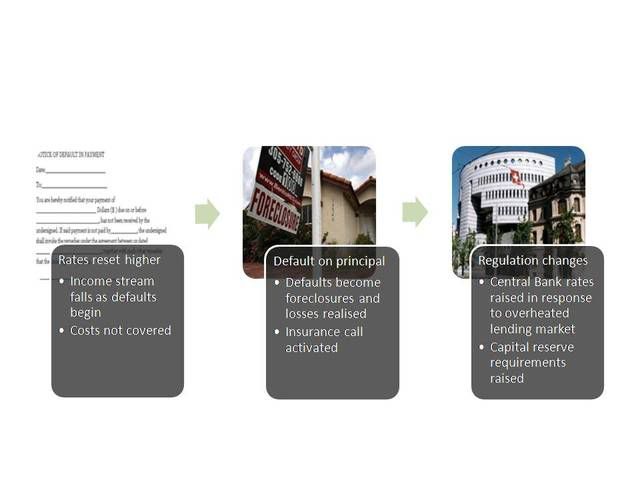

- 1. Interest income does not cover costs.

If the amount of interest charged is too low to cover costs, interest rates on variable products can be raised. If the product is fixed rate then either customers can be encouraged to take variable rates that can be reset higher (after a lower introductory offer) or the debt can be packaged together and sold on to another party at a discount.

2. The principal may not be repaid.

The bank will invoke its insurance policy to cover the losses if the principal worth is calculated to have dropped below a certain level previously agreed with the Insurer. The payout can then be added to the reserves to ensure the bank complies with regulations.

3. Regulations change.

If the governing body decides that banks need to hold a higher percentage of reserves compared to lending then capital must raised to boost the reserves (e.g. Basel 2). This can be achieved by borrowing, rights or bond issues or by reducing the amount of lending.

Any one of these circumstances alone would not cause bankruptcy. Even a half decent capitalised bank could survive 2 of these events running concurrently. However if banks (and the Insurers and other lenders) have stretched the leverage out to 20, 30 or 40 times reserve capital and all 3 of these circumstances arrive at the same time you then have a credit crisis.

Remember the financial system relies on confidence. If confidence in the survivability of the system or part of the system is impaired then the structure slows and stops. In an extreme crisis the system may well go into reverse. Sub-prime became the headline for the current crisis but it is just a manifestation of the events above all occurring at the same time:

In many ways the 3 events almost seem to have been perfectly timed to cause the maximum damage, with rates moving higher from 2004 to 2006, just as many sub prime, Alt A and jumbo mortgages began to reset from teaser rates to higher nominal rates. In 2007 and 2008 capital requirements and the accounting and pricing of assets changed as Basel 2, sponsored by the Bank of International Settlements (BIS) came into force.

Certainly anyone in an informed position could have seen that the situation was set to deteriorate rather than stabilise. Without doubt the effects of these events where under-estimated by those charged with ensuring the Financial and Monetary system remained fit for purpose.

How is the financial system made fit for purpose?

Let me say that the methods used to make the credit system work again will be the same as those employed previously. Right now the world worries about inflation. Inflation is simply too much cash and credit chasing too few goods. Any asset or commodity that is in short supply will attract funds, causing the price of that asset to go higher.

The traditional method to control inflation is to raise interest rates, causing cash to be saved as returns become attractive and restricting the use of credit as it becomes prohibitively expensive. However there is another method that can be used.

Think of cash/credit as an asset. If you want the price of an asset to rise you make it scarcer, you restrict the amount available. As cash becomes more valuable the amount needed to buy less scarce assets drops. A s we are talking about cash that means the price of commodities etc falls.

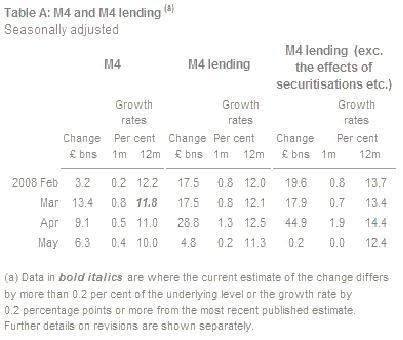

Are central banks restricting the flow of cash into the financial system? Here are the latest money supply M4 figures (£ billions) for the Bank of England (The Federal Reserve will follow the same path, in time):

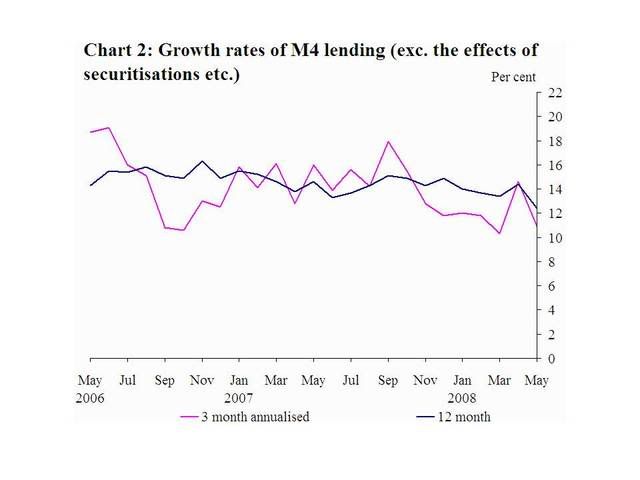

Whilst the growth of M4 continues we can see a slowing in the growth rate. The amount of cash and credit available in sterling is slowing:

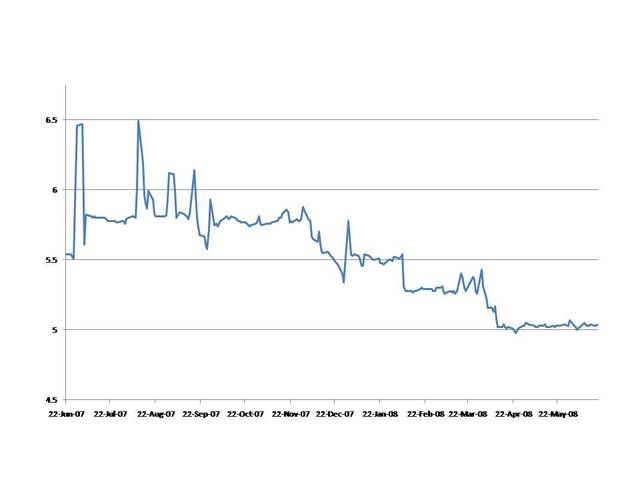

This slowing of issuance and availability makes sterling more valuable, especially if the interest rate is attractive (this is the overnight interbank rate for sterling from Jun 07):

Notice the falling interest rate coincides with the slowing of M4 growth? As sterling becomes "rarer" the rate of return required on investment falls. Sterling itself appreciates, requiring less compensation in the form of interest. If you look back at the M4 growth chart, you can see that the 3 month rate of growth has been lower than the 12 month rate for some time (the blip in March was the second round credit crunch effects liquidity "save"). If the 3 month ROG remains like this then growth of the amount of sterling will continue to contract over the medium (12-24 months) term.

This is an anti-inflationary move by the Bank of England, yet the rhetoric over recent days has been about inflation fears. The increased rhetoric is to counteract inflation expectations and the fear that a widespread demand for greater wage increases will take hold, as the Bank of England Governor, Mervyn King, alluded to in a speech last week:

- "The immediate cause of the current pickup in inflation is increases in food and energy prices relative to other prices. They are caused by the pressure of demand on the supply of food and energy in the world as a whole. Part of that pressure may well reflect expansionary monetary policy in the world as a whole. But the rise in commodity prices cannot, by itself, generate sustained inflation in the United Kingdom unless we allow it to. We will not. So although inflation in the UK will rise in the short term, inflation will then fall back.

That means that the rate of increase of other prices and domestic costs, notably pay, must remain low. The MPC does not take that for granted. Surveys - including our own -indicate that expectations of inflation have risen, meaning that inflation is likely to have some tendency to persist. That is why, as I explained in my letter to the Chancellor, we believe that a slowdown in the economy this year, creating a margin of spare capacity, will be necessary to dampen price and wage pressures and ensure that we fulfill our remit by returning inflation to the target. And growth is now slowing quite sharply - broad money growth is falling, business surveys point to particularly weak output growth in the second quarter and growth is likely to remain subdued for the rest of the year."

Read that extract carefully, within it are terms couched for the ears of business and economists. The threat is that if inflation expectations lead to higher wage demands then interest rates will rise. However King then goes on to explain why he thinks the rising inflation expectations will be quashed:

- "we believe that a slowdown in the economy this year, creating a margin of spare capacity, will be necessary to dampen price and wage pressures"

In other words the cutting of M4 growth rates is being carried out to deliberately slow economic growth. By restricting the availability of cash and credit the economy will slow to a recessionary level where business will create a "margin of spare capacity" also known as unemployment. As I mentioned earlier the methods used to make the credit system fit for purpose are and will continue to be the same as those used previously.

The result, for ordinary mortals, will be an increasing difficulty in finding work, a greater fear that current employment may be curtailed and a reluctance to ask for higher wages. Savings will grow as non-essential spending is curtailed during an uncertain period, further reducing the availability of sterling circulating in the economy. Interest rates will remain high relative to discretionary income until the Bank of England decides that the Financial and Credit systems are once again fit for purpose.

The recession that will occur over the next 12-18 months is being deliberately engineered. Any growth in M4 will be redirected from the public to the banks, allowing the banks to repair their depleted reserves. Once these reserves are rebuilt lending standards will be loosened, allowing credit expansion to begin again. By that time interest rates will have been lowered, making the use of credit attractive, encouraging consumption and investment and helping GDP to expand. Another cycle of boom will then be initiated.

Less than 12 months ago the phrase "financial innovation" was still given credence, the "end of boom and bust" was still uttered to justify an economic third way. Now both phrases are discredited (pun intended) and have turned to ashes in the mouths of those who uttered them.

I have outlined above the truth of the current situation, how the greed of lenders caused a fatal weakness in the financial system and how ordinary people will have to deal with the results. A recession will be deliberately engineered to slow growth and allow banks to recover. As throughout history those that suffer in economic hard times are not those who profited in the boom. The masses will bear the burden and wonder what they did wrong to be placed in such hard times.

This article is to inform the public that the only thing they did wrong was to believe the rhetoric, the jawboning that was fed to them during the boom. The current situation is about to get much worse, it will not be due to higher wage claims, lack of productivity or uncompetitive practices. It will be because the politicians and bankers follow an economic system that is inherently flawed.

Until the public become educated about the way in which they are used to allow banks and governments to recover from "busts" and change the way they are led, then the banks and governments will continue to operate in their own interest, regardless of what becomes of the people. That education will not occur at the behest of governments or through the increased transparency of banking procedures and methods. It is up to us to try and let the people know what is happening. So use this article, reproduce it on blogs and sites and send it to others. All I ask is the following line is included:

Copyright: M Phoenix 2008. An Occasional Letter From The Collection Agency. Use of this article is unrestricted other than the inclusion of this acknowledgement.